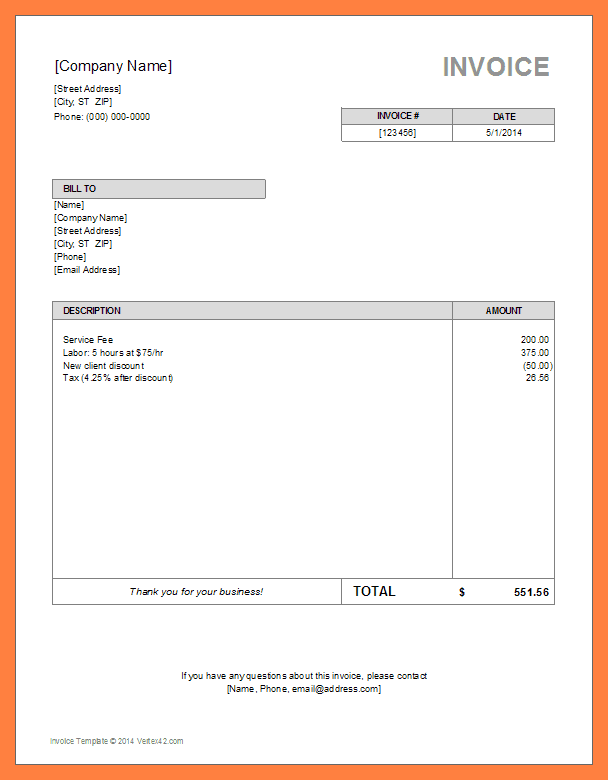

Enter VAT rate & amount (if applicable).Enter service particulars, rate and quantity.Fill in your client details - contact person name, company name, complete address with post code.Enter invoice date, due date and payment terms.You can download and use our VAT invoice template to keep it simple. For example, if your service fee is £1000, and if VAT is 20% then, your total invoice amount will £1200 (£1000 + £200 VAT). You will have to include your VAT registration number in the invoice, and you'll have to add 20% VAT or whatever rate is applicable at that time, to the invoice amount. If your limited company is VAT registered, you'll need to generate a VAT invoice.

Invoice number must be unique and sequential (especially if your company is VAT registered).Complete limited company details are a must.INVOICE word on the invoice document is mandatory.Your invoice must include the following information: Once your invoice is ready, you can either email the invoice (ideally in a PDF format) or post it to your client or you can do both.Please ensure that these details are correct as it may delay your payment

Payment instructions – this section would cover how you would like to receive the payment, your limited company bank details (account number and sort code).Description – In this section, you would have to mention the services you rendered to your client, quantity, price / cost / fee, VAT amount / percentage, Gross and Net amount.Client Details – Client name, company name and address.Payment Terms – Although not mandatory, it is advisable to include payment terms, if any.Due Date: This will be the date by which your client would need to settle the invoice or clear your dues Invoice Date: This will be the date when you generate your invoice There’ll be 2 types of dates you would need to include: Try to keep it relevant and use a combination of letters and numbers, for example, if your client is Centrica and you are invoicing them for t, then you may use Centrica001 Unique Invoice Number (UIN) – Again, this is extremely important and mandatory.Ideally, this should be the first thing on your invoice document

0 kommentar(er)

0 kommentar(er)